Your landlord

market update.

Welcome to our latest landlord market update.

We cut through the noise to bring you the insights that matter.

Key highlights:

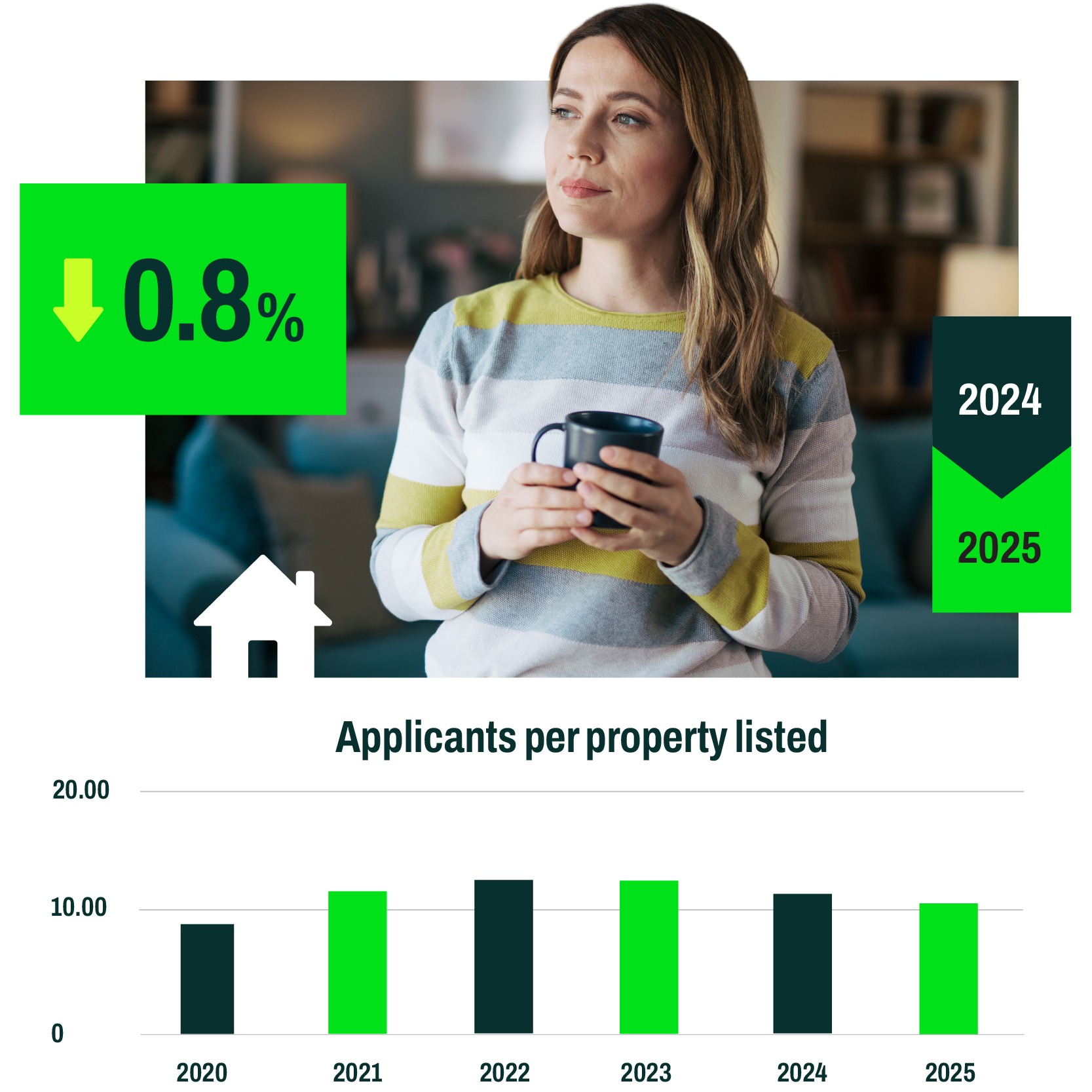

- 9.77 applicants per property across the past 12 months, demonstrating continued demand.

- 94.6% instruction-to-let ratio in 2025, reflecting strong pricing alignment and tenant appetite.

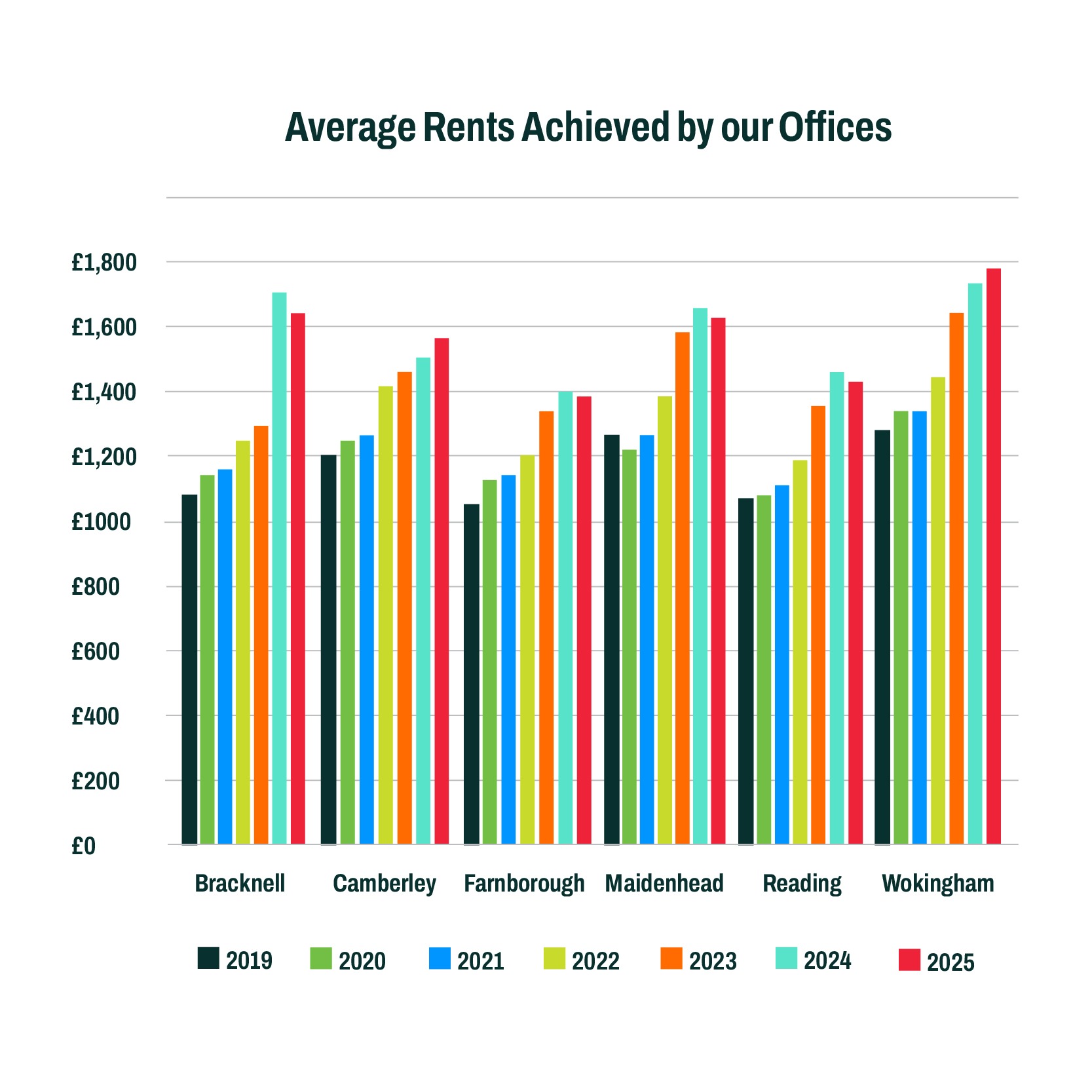

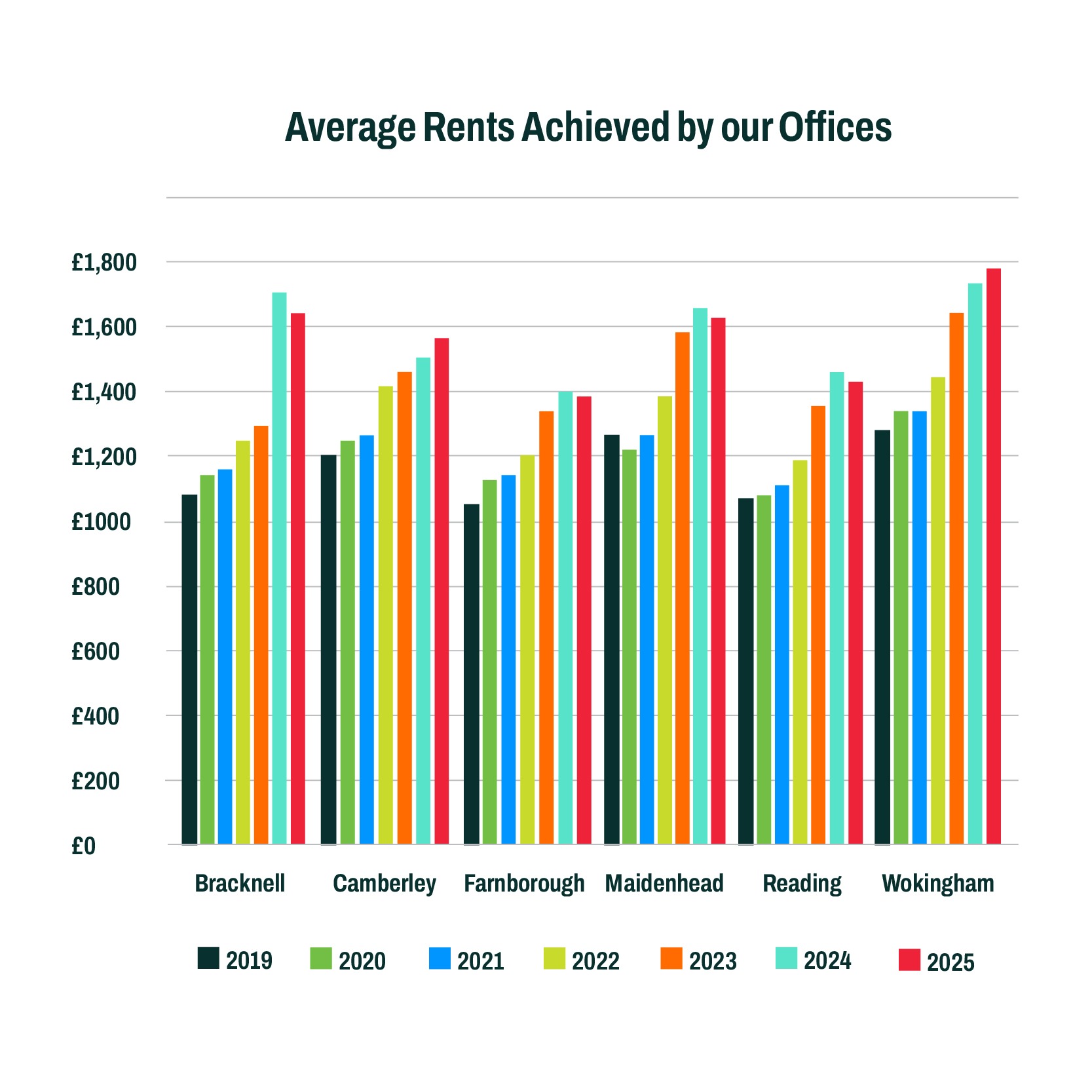

- £1,156 to £1,560 average rent growth since 2019 - a 34.95% uplift over six years.

- 98.65% rent collection rate, supporting stable landlord income.

- Across our Fully Managed and Rent Collect portfolio, including tenants currently in situ, the average tenancy length stands at 40.85 months (3.4 years), materially reducing turnover and income disruption.

- Prospect listed 6% more stock year-on-year, outperforming the wider market’s 4.94% growth.

- Lets agreed increased 10.34% year-on-year, compared to 3.12% across the wider market.

A Message from our Lettings Director - Michael Gallagher.

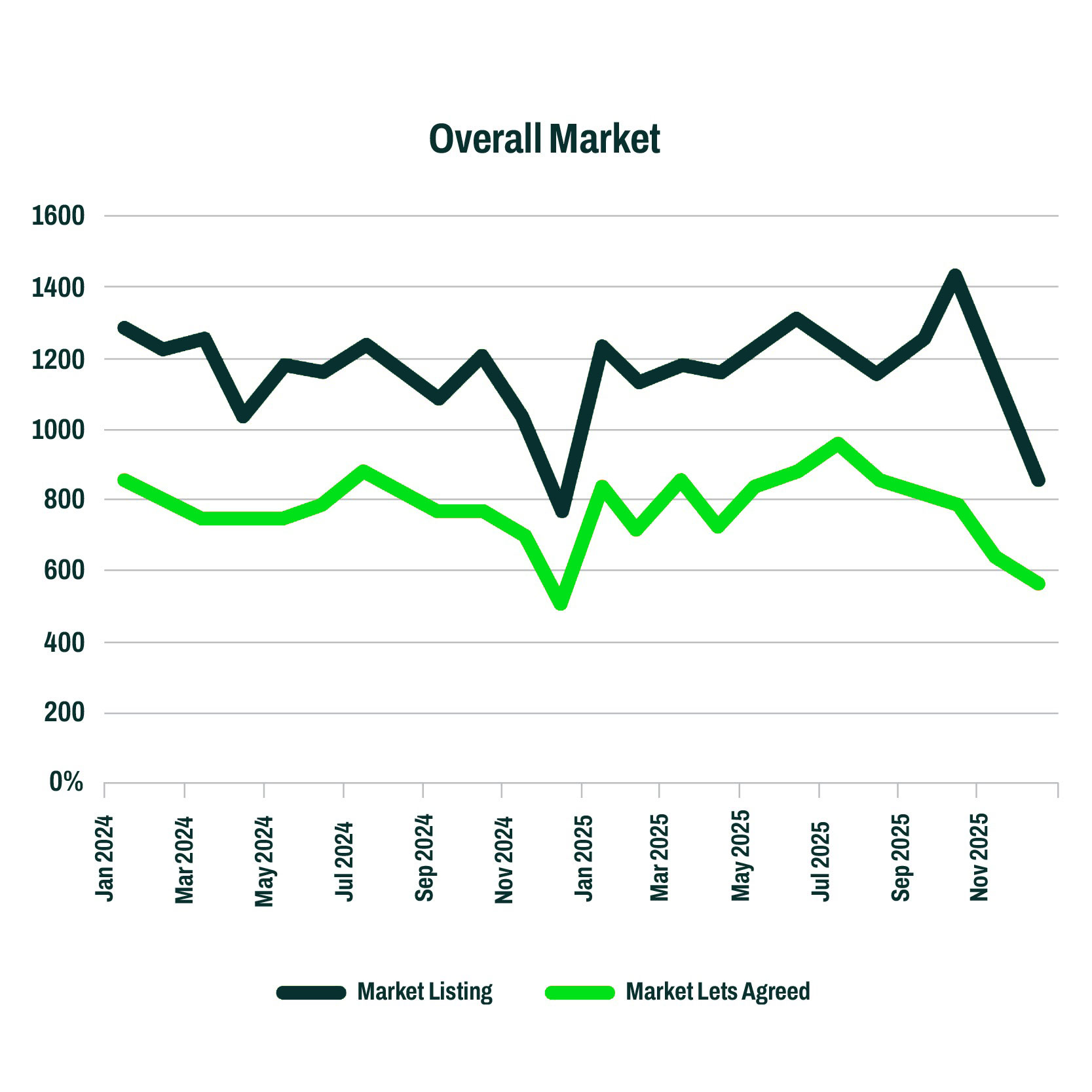

The Renters’ Rights Act represents a fundamental change in the private rental sector. As we entered 2026, market conditions continued to normalise following the elevated activity seen between 2021 and 2023.

January data provides a clear snapshot of this adjustment:

- Prospect averaged 9.22 applicants per listing, compared to 10.79 in January 2025.

- Across the wider market (Rightmove), properties coming to market increased by 8.7% year-on-year, while lets agreed rose by 3.8% over the same period.

Applicant volumes have moderated from peak levels as supply has increased. However, activity remains competitive, and appropriately priced properties continue to secure tenants efficiently.

In a more balanced market, portfolio performance is increasingly driven by retention, income security and management discipline rather than short-term demand spikes.

Under the new legislative framework, this stability becomes increasingly important.

Open-ended tenancies, revised possession grounds and annual rent review limits mean landlord strategy must prioritise:

- Disciplined tenant selection

- Accurate compliance

- Long-term income protection

This environment increasingly favours structured management over reactive pricing.

With more than £1.5 billion of residential assets under management and a rent roll exceeding £63 million, our focus remains consistent: stable occupancy, controlled growth and reduced portfolio volatility.

Tenant demand: Stabilising from peak, remaining strong.

Over the past 12 months, we have averaged 9.77 applicants per available property, compared to 10.45 the previous year - a measured 6.5% moderation from peak levels, yet still materially above pre-pandemic norms.

Our internal instruction-to-let ratio in 2025 stood at 94.6%, demonstrating continued demand depth and pricing accuracy.

From tenant secured to completion, our average progression time was 19.3 days, reflecting efficient transaction management and reduced exposure to extended voids.

Rental growth: Long-term uplift, now sustainable.

Average monthly rents across our offices increased from £1,156 in 2019 to £1,560 in 2025, representing a 34.95% uplift over six years.

The period of rapid escalation has transitioned into steadier annual growth, reflecting improved affordability balance and regulatory change.

In 2025 alone:

- Over 65% of our landlords benefited from negotiated rent increases

- Portfolio rent collection performance remained strong at 98.65%

As possession timelines and recovery routes evolve under the Renters’ Rights framework, protecting against the minority of cases where arrears arise forms an increasingly important part of prudent income risk management.

Under the new legislation, rent increases will be limited to once per year, reinforcing the importance of long-term tenant strategy over reactive pricing.

Income consistency now plays a greater role in portfolio performance than short-term rental maximisation.

Tenant profile: Consistent and predictable.

Over the past 12 months:

- 39% of registered applicants were aged 21–30

- 29% were aged 31–40

This means 68% of demand continues to sit within the core 21–40 demographic.

Across our Fully Managed and Rent Collect portfolio:

- 63.7% of tenancies renewed in the last 12 months

This level of renewal activity supports stable occupancy and predictable income streams across the portfolio.

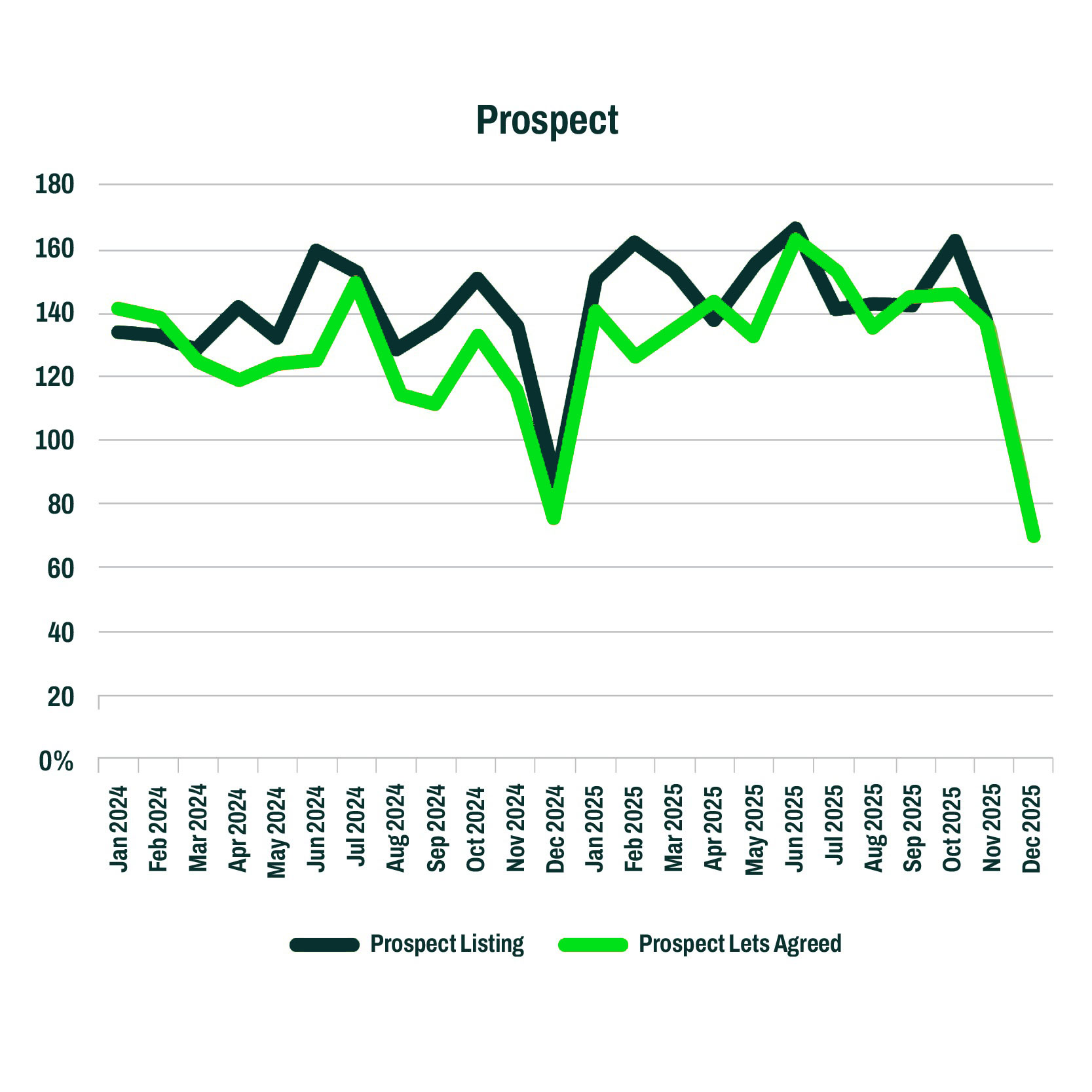

Supply & market positioning: Outperforming the wider market.

In 2025:

- Prospect listed 1,715 properties, compared to 1,618 the previous year - a 6% increase in available stock

- The wider market across our areas increased by 4.94% over the same period

Despite increased stock levels:

- Prospect’s lets agreed increased 10.34% year-on-year

- The wider market increased by 3.12%

This reflects continued market share strength and effective pricing alignment within a stabilising environment.

Residential sales market: Long-term capital stability.

Average sale prices across our areas increased from £433,073 in 2024 to £440,615 in 2025, representing 1.74% year-on-year growth.

Since 2020, average sale prices have increased from approximately £388,000 to £440,615, reinforcing long-term capital resilience.

With mortgage conditions easing, modest but steady capital growth is anticipated through 2026.

Prospect Portfolio Snapshot (2025).

- 3,500+ Fully Managed & Rent Collect units

- £1.5+ billion asset value under management

- £63+ million annual rent roll

- 98.65% rent collection rate

As legislative and compliance requirements increase, the distinction between structured management and informal oversight becomes more significant.

Landlords operating within a proactive management framework are better positioned to manage rent reviews, regulatory changes and possession processes with reduced operational risk.

Are you Renters’ Rights ready?

Phase 1 – Effective 1 May 2026

- Tenancies move to open-ended agreements

- Section 21 removed

- Updated possession grounds

- Rent increases limited to once annually

- Stronger tenant rights regarding pets

These reforms increase the importance of:

- Accurate referencing

- Robust documentation

- Proactive compliance management

- Strategic rent review planning

Landlords operating within a structured management framework are best positioned to navigate this transition with confidence.

Michael Gallagher

Director

To discuss the insights presented within this report, or for personalised advice, please contact Michael Gallagher on email at [email protected]

Why you should choose Prospect

- 99% rent collection success

- Less than 3% dispute rate

- 99% retention rate

- 7% average rent growth (Based on 2024 tenancy renewals)